ITIN Application

ITIN Number Application

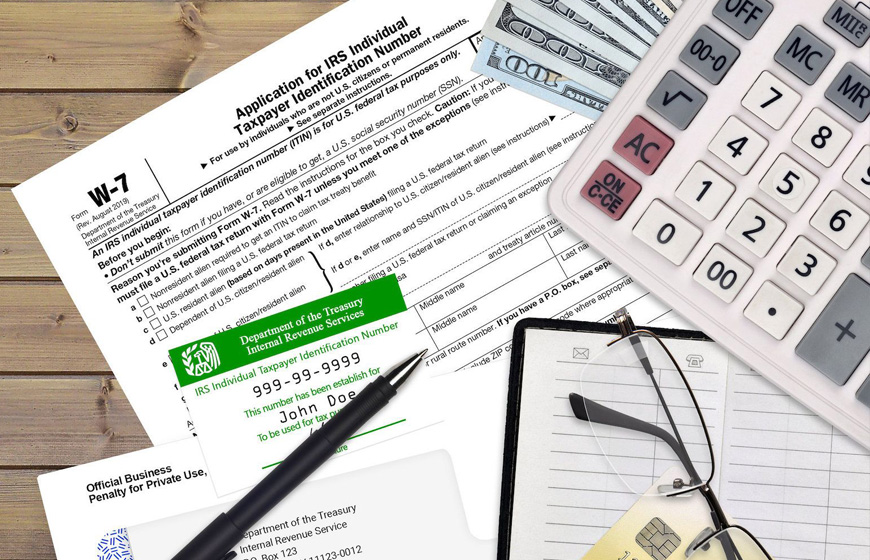

No Social Security Number? We can help you get an Individual Tax Identification Number (ITIN), so you can file your taxes.

ITIN Number Application

If you’re working and earning money in the United States, but you don’t have and don’t qualify for a Social Security Number, you’ll need an ITIN. You can apply for an ITIN tax ID for you, your spouse, and your dependents when you prepare your tax return with us. Here’s what an ITIN can help you do.

File taxes and claim benefits

File your taxes and claim tax benefits for qualifying dependents.

Receive a tax refund

Get a refund of income tax withholding from the IRS, if you qualify.

Open a bank account

Open a bank account or apply for a mortgage loan, if you qualify.

Why do I need an ITIN?

Let’s say you’re working and earning money in the United States, but you don’t qualify for a Social Security Number (SSN). An ITIN (Individual Taxpayer Identification Number, type of Tax ID or Taxpayer ID) will serve as your identification number for filing your tax returns. If you do not qualify for an SSN, you will need to apply for an ITIN.